Odfjell Drilling is focused on maintaining a robust balance sheet and conservative capital allocation strategies. As part of this focus, we will continue to deleverage our company by reducing our net debt to EBITDA ratio over time whilst maintaining solid liquidity to manoeuvre the cycles and capture attractive growth opportunities.

To facilitate our long term strategy, our capitalisation structure includes a mixture of bank facilities and a rated bond which are detailed below.

| Instrument | USD 650m senior secured 1st lien bond Issued 8 December 2025 | USD 300m senior secured bank facility Deepsea Stavanger | USD 250m senior secured bank facility Deepsea Bergen |

|---|---|---|---|

| Borrower: | Odfjell Rig III Ltd | Odfjell Invest Ltd | Odfjell Drilling Malta Ltd |

| Guarantors: | Odfjell Drilling Ltd, Odfjell Rig Owning Ltd., relevant rig owners and charter companies | Odfjell Drilling Ltd, Odfjell Rig Owning Ltd., Deep Sea Stavanger (UK) Ltd, Deep Sea Rig AS | Odfjell Drilling Ltd, Odfjell Rig Owning Ltd., Deep Sea Bergen Ltd., Deep Sea Bergen Drilling AS |

| Collateral Rigs: | Deepsea Aberdeen, Deepsea Atlantic, Deepsea Nordkapp | Deepsea Stavanger | Deepsea Bergen (renamed from Bollsta in 2026) |

| Loan principle: | USD 650m | Term loan USD 150m Reducing RCF USD 150m | Term loan USD 100m Reducing RCF USD 150m |

| Repayment: | Semi-annual instalments of USD 22.5m, first time 9 months from issue date | TL: Quarterly instalments of USD 8.3m. Full payout to maturity. RCF: Quarterly reductions of USD 5m down to balloon of USD 50m | TL: Quarterly instalments of USD 2.5m down to balloon of USD 52.5m. First instalment after six months. RCF: Quarterly reductions of USD 3.75m down to balloon of USD 78.75m. First reduction after six months. |

| Pricing | 7.25% coupon | Margin 270-295 bps over SOFR | Margin 295 bps over SOFR |

| Maturity | March 2031 | TL: June 2030 RCF: January 2031 | TL: January 2031 RCF: January 2031 |

| Security | Standard 1st lien security including rig mortgage, share pledges, account pledges and assignments in earnings and insurances | Standard 1st lien security including rig mortgage, share pledges, account pledges and assignments in earnings and insurances | Standard 1st lien security including rig mortgage, share pledges, account pledges and assignments in earnings and insurances |

| Financial Covenants | i. Equity Ratio ≥ 30%; ii. Free Liquidity (incl. undrawn RCF) ≥ USD 50m iii. Current Ratio ≥ 1.0x | i. Book Equity ≥ 30% and ≥ USD 600m ii. Leverage Ratio ≤ 3.0x iii. Current Ratio ≥ 1.0x iv. Free Liquidity (incl. undrawn RCF) ≥ USD 50m v. Total cash (incl. undrawn RCF) ≥ 7.5% of gross interest-bearing debt (incl. undrawn RCF) | i. Book Equity ≥ 30% and ≥ USD 600m ii. Leverage Ratio ≤ 3.0x iii. Current Ratio ≥ 1.0x iv. Free Liquidity (incl. undrawn RCF) ≥ USD 50m v. Total cash (incl. undrawn RCF) ≥ 7.5% of gross interest-bearing debt (incl. undrawn RCF) |

| Dividend Covenants | i. no Event of Default has occurred; ii. the Leverage Ratio shall be ≤ 2.25x first 24 months and ≤ 2.0 thereafter Total Liquidity (incl. undrawn RCF) of ≥ USD 100m | i. Leverage Ratio shall be < 3.0x ii. Free Liquidity (incl. undrawn RCF) of ≥ USD 75m | i. Leverage Ratio shall be < 3.0x ii. Free Liquidity (incl. undrawn RCF) of ≥ USD 75m |

| Minimum Value Clause | n.a. | Minimum 140% | Minimum 140% |

| Leverage ratio adjustment | EBITDA and Net Interest Bearing Debt related to a newbuilding or fleet addition of a drilling rig/vessel may be disregarded until up to six (6) months from the delivery date for such unit. From inclusion, actual EBITDA from the commencement date of any firm employment contract for such drilling rig/vessel shall be annualised until a full twelve month earnings history related to that newbuilding or other fleet addition has been achieved. If, from inclusion, no firm employment contract has commenced, but the relevant unit has a firm contract, of at least twelve (12) months duration, that starts within six (6) months thereafter, then EBITDA on such employment contract shall be included for the full relevant period, on a pro-forma basis. | ||||

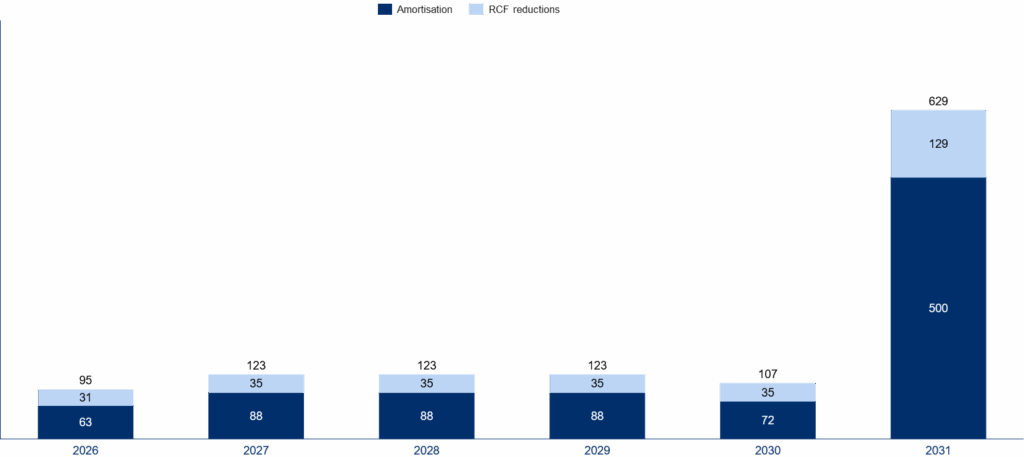

Repayment Profile

Odfjell Drilling has no significant debt maturities until 2031 and has a stable repayment profile, allowing for strong free cash flow generation.

Credit Rating Agency Reports

Odfjell Drilling Ltd and the Odfjell Rig III Bond is rated by Moody’s and S&P with ratings of B1 / B1 and B+ / BB, respectively.

To access the individual reports, please use the following hyperlinks.

Bond Details:

Debt Level: First lien security related to the Deepsea Aberdeen, Deepsea Nordkapp and Deepsea Atlantic

Issue: USD 650,000,000

Coupon: 7.25%

ISIN: NO0013698159

Maturity Date: 8 March 2031

Currency: USD

Bond Terms:

Odfjell Rig III Financial Reports

Q2 and First Half year of 2023 Financial Results

Q4 2023 and Full year of 2023 Financial Results